“What is measured is improved” they say, so we publicly track our expenses here each month to hopefully fulfill that axiom.

We have a few goals for these monthly reports:

- Keep ourselves accountable and aware of our monthly expenses (do we really eat out that much?!)

- Receive feedback from you on where you see room for improvement

- Reduce overwhelm in us and you that budgeting and planning for retirement expenses is too big and broad to figure out by breaking down each month into specific areas that are more manageable

- Help keep us motivated as we see how little (hopefully!) we are spending

- Keep us mindful of our purchases and aware of any trends in excess spending

- Indulge the naturally curious part of you that wants to compare yourself to us

It’s important to note that these reports are based off our take home pay (after taxes, retirement, and healthcare have been withheld) so you won’t see those listed. We understand that some people prefer to include those items in their overall expense tracking, but that’s not the method for us (although if you want to try to persuade us to change, we are open to your thoughts).

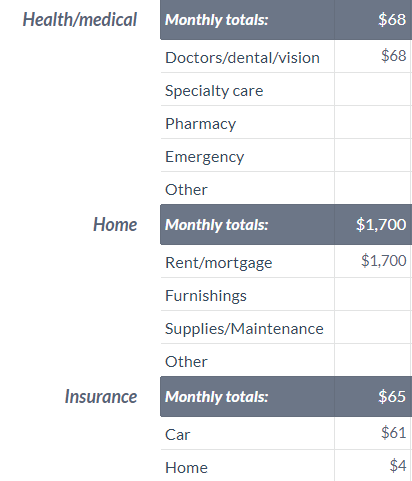

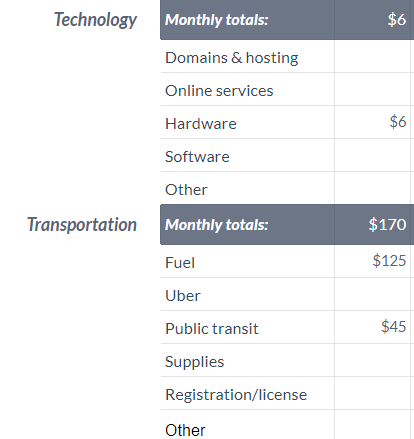

So with that, here are our June 2019 Expenses:

Total June Expenses: $3,270

This month we were excited to have half a year of data to project trends and see where we are headed. In particular, we looked at the last six months to see what our current average savings rate is and how long it will take us to reach our goals if we don’t really make any changes.

The results were both exciting and demoralizing. We are definitely saving more than 50% of our income, which is super and pretty much a basic tenant of reaching FI. So seeing that was a real confidence boost.

Then we made the mistake of using a calculator to see how long we are projected to take to reach FI at this rate and it came out to 8 years. That’s disheartening because we are both very ready to be done with our current work life. Eight years is a long time.

But it’s good to know what we are doing and have a baseline to move forward from. We realize that we are spending much more than we had anticipated and that will help motivate us to bring in more side hustles and cut down on expenses moving forward.

All in all we know we are in this for the long (but as short as possible) haul and having good data to track our habits will put us in a better place when we get there.

What do you do to keep motivated on the path to FI? What do you do when reviewing annual or semi-annual expenses and planning for the next period? We would love to know.