“What is measured is improved” they say, so we publicly track our expenses here each month to hopefully fulfill that axiom.

We have a few goals for these monthly reports:

- Keep ourselves accountable and aware of our monthly expenses (do we really eat out that much?!)

- Receive feedback from you on where you see room for improvement

- Reduce overwhelm in us and you that budgeting and planning for retirement expenses is too big and broad to figure out by breaking down each month into specific areas that are more manageable

- Help keep us motivated as we see how little (hopefully!) we are spending

- Keep us mindful of our purchases and aware of any trends in excess spending

- Indulge the naturally curious part of you that wants to compare yourself to us 😉

It’s important to note that these reports are based off our take home pay (after taxes, retirement, and healthcare have been withheld) so you won’t see those listed. We understand that some people prefer to include those items in their overall expense tracking, but that’s not the method for us (although if you want to try to persuade us to change, we are open to your thoughts).

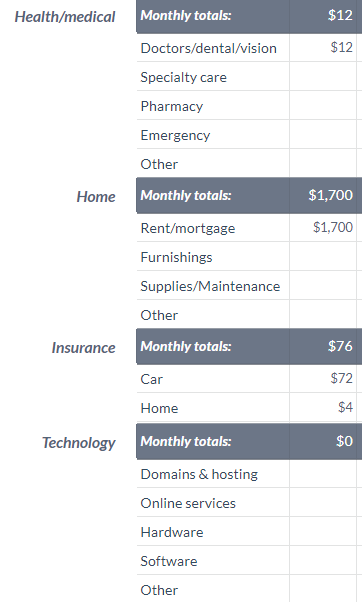

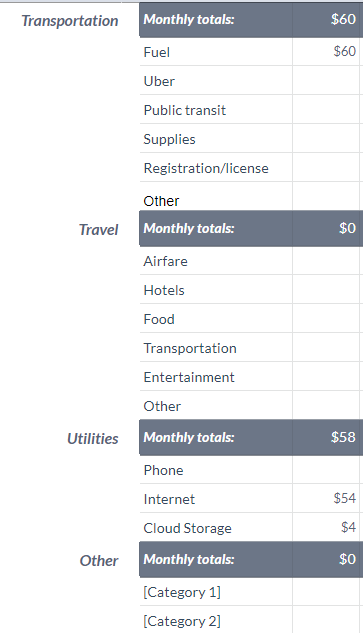

So with that, here are our April 2019 expenses:

Total April Expenses: $3,318

Honestly, we thought this month was going to be a lot worse.

We had a really fun weekend planned with about 10 people and since we hosted, we were a little concerned about what this month would look like. But, if you’ve been paying attention, this is actually one of our best months!

While we’re happy with how it all turned out, we still wanted to dig into where some unusual spending happened so we can be aware of our habits.

So just to note, here were some “special” items for the month:

- Food for event weekend

- Friend in town (led to lots of eating out)

- Stocked up on food items/vitamins

- Clothes for an upcoming trip and our weekend event

- Concert tickets for both Mr. and Mrs. FInding

We’re really enjoying tracking and becoming more aware of what we’re actually spending. It makes our daily awareness feel worth it.

Does anyone else find it rewarding to look at their spending (or lack thereof!) at the end of the month?